wichita ks sales tax rate 2020

Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4. As of 2019 946 of Wichita KS residents were US citizens which is higher than the national average of 934.

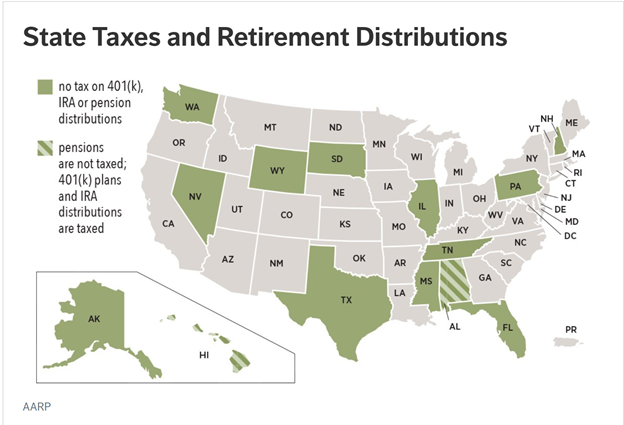

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

The minimum combined 2022 sales tax rate for Wichita Kansas is.

. 2020 Chevrolet Equinox Lt. 31 Wichita Ks Sales Tax Rate 2019. For tax rates in other cities see Puerto Rico sales taxes by city and county.

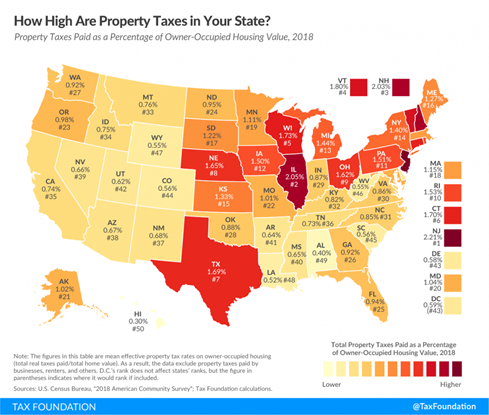

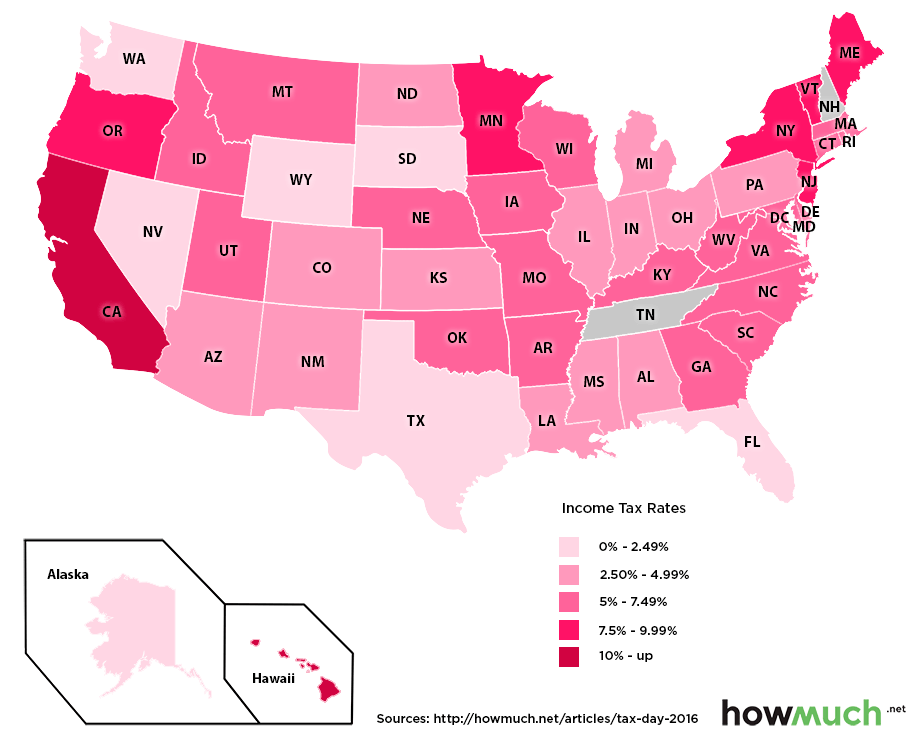

The highest Kansas tax rate increased from 52 to 57 in 2018 up from 46 for the 2016 income tax year. Average Sales Tax With Local. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

For tax rates in other cities see Kansas sales taxes by city and county. Wichita collects the maximum legal local sales tax. There is no applicable city tax or special tax.

3 lower than the maximum sales tax in KS. Kansas state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with KS tax rates of 31 525 and 57 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The December 2020 total local sales tax rate was also 7500.

The combination of our expertise experience and the team mentality of our staff assures that you will receive the. In wichita the rate is six percent. You can print a 75 sales tax table here.

Sales Tax State Local Sales Tax on Food. In Wichita the rate is six percent. Subscribe to our Newsletter Submit.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. Kansas state income tax rate table for the 2020 2021 filing season has three income tax brackets with KS tax rates of 31 525 and 57 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. In 2020 it was 32749 based on the Sedgwick County Clerk.

31 rows The state sales tax rate in Kansas is 6500. The County sales tax rate is. There are a total of 376 local tax jurisdictions across the state collecting an average local tax of 1552.

The City of Wichita property tax mill levy rose slightly for 2021. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. For tax rates in other cities see Kansas sales taxes by city and county.

This is the total of state county and city sales tax rates. Jonathan Silvey - June 18 2020. The Kansas sales tax rate is currently.

A week after approving a 22 hike that customers will pay for a natural gas franchise tax For the second meeting in a row the Wichita City Council approved a 27 sales tax increase in the development around the new baseball stadium and on the east bank of the Arkansas River including the Boathouse and Waterwalk developments. With local taxes the total. Burghart is a graduate of the University of Kansas.

Jurisdiction codes are used by retailers in completing their sales and use tax returns. There are also local taxes up to 1 which will vary depending on region. The December 2020 total local sales tax rate was also 8500.

There is no applicable city tax or special tax. Kansas has a 65 sales tax and Sedgwick County collects an additional 1 so the minimum sales tax rate in Sedgwick County is 75 not including any city or special district taxes. As of the 2020 census the population of the city was 397532.

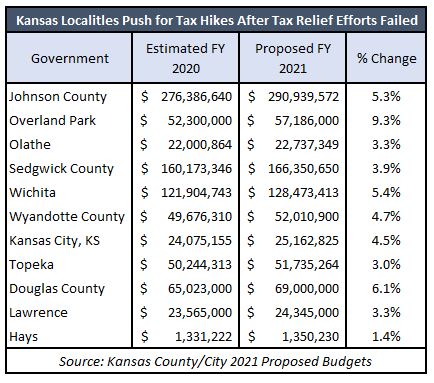

No tax rate should ever go up. Select the Kansas city from the list of popular cities below to see its current sales tax rate. To raise the tax rate is an indicator that government is growing at a faster rate than the privet sector or is doing a very bad job at spending our money.

At the same tax rate government revenues would increase at the same rate as prices incomes and property values. The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax.

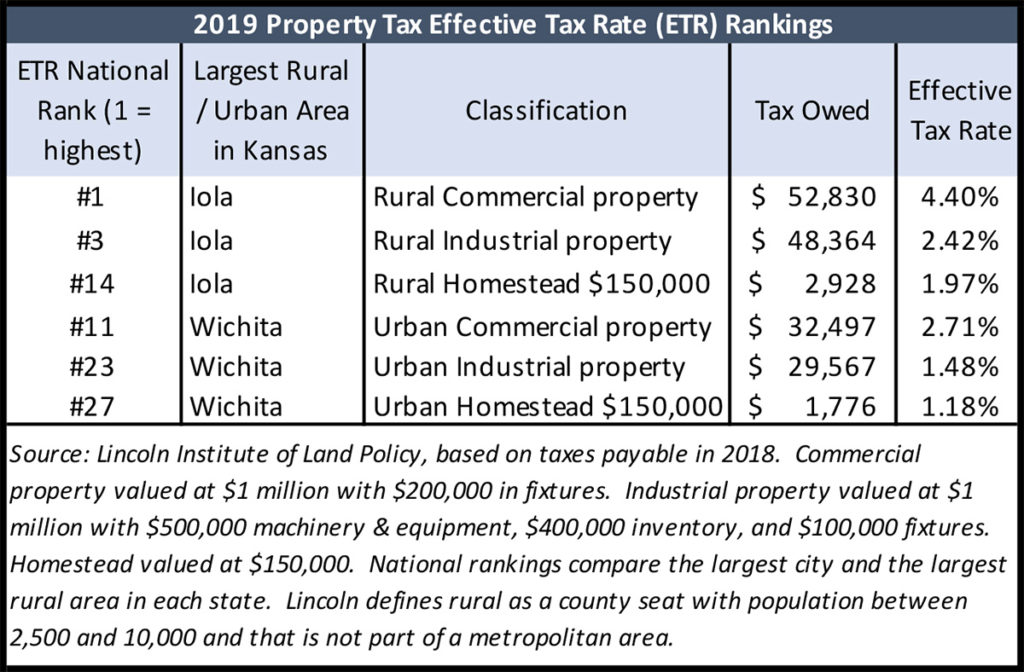

In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290. For 2021 the rate is 32758 an increase of 037 mills or 011 perent. Pleasebeadvised that notification of local sales tax rate changes will no longer be mailedLocal sales tax rates changes occur quarterly and are published on our website 60 days in advance see EDU-96For a current listing of the sales tax rates visit the KansasDepartment of Revenue website at.

Wichita County KS Sales Tax Rate The current total local sales tax rate in Wichita County KS is 8500. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. The Wichita sales tax rate is.

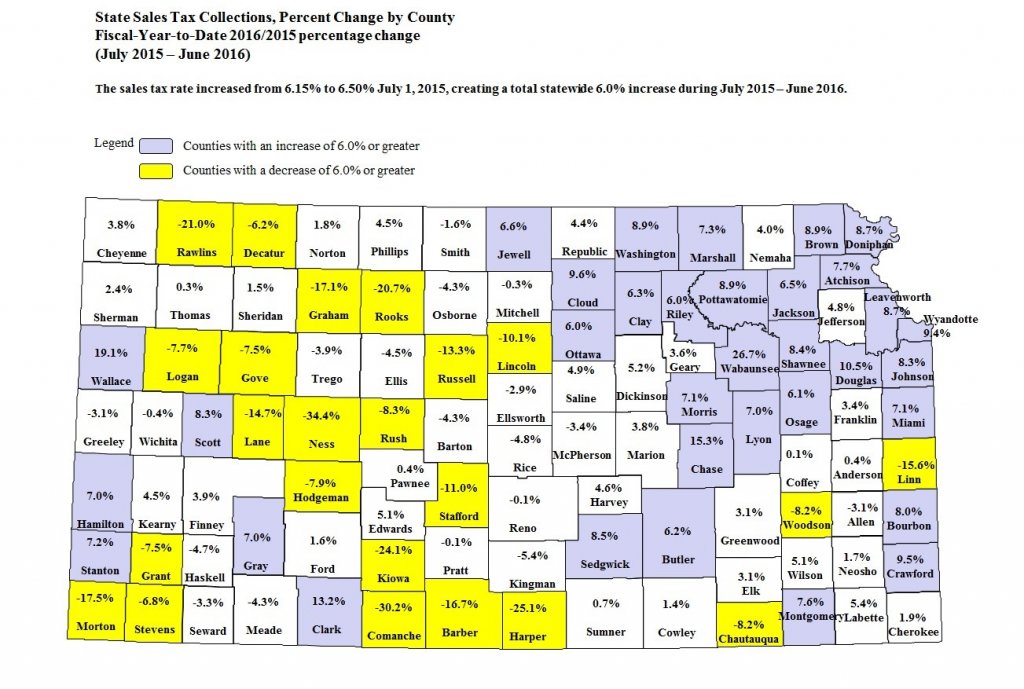

Sales tax is expected to erode in 2020 due to the stay at home order and recession. The total sales tax rate in any given location can be broken down into state county city and special district rates. This table shows the total sales tax rates for all cities and towns in Sedgwick.

You can print a 75 sales tax table here. Ks sales tax rate. BFR CPA LLC is one of the leading tax and accounting firms in Wichita Kansas and the surrounding area.

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

My Local Taxes Sedgwick County Kansas

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Which U S States Have The Lowest Income Taxes

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Kansas Sales Tax Update Remote Seller Guidance Wichita Cpa

Kansas Counties And Cities Hike Taxes Amidst Covid Recession Kansas Policy Institute

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Texas Sales Tax Calculator Reverse Sales Dremployee

Taxes And Spending In Nebraska

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Tax Cuts And The Kansas Economy Kansas Policy Institute

Kansas Sales Tax Update Remote Seller Guidance Wichita Cpa

Kansas Sales Tax Rates By City County 2022

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Wichita Property Tax Rate Up Just A Little

Sales Tax Rates In Major Cities Tax Data Tax Foundation

What Is Texas Sales Tax Discover The Texas Sales Tax Rate For 254 Counties